|

March, 2015

|

|

Dear Friends and Partners,

|

|

Many of you may wonder what the current political crisis in Eastern Europe may mean to agricultural producers and markets. In the short run these uncertainties together with respective political interventions will of course have bullish effects on commodity markets.

|

|

| However, whether there is a reason to assume that global markets will remain tight in the long run remains to be seen. In this newsletter we share with you a paper on this very topic. The conclusion is, it is rather likely that prices will go down again significantly. We are curious about your thoughts on this – let us know. |

| A second topic we address relates to rice in Asia – booming economies and increasing wage rates in countries such as Vietnam or Thailand create a significant challenge to labor intensive small holder production systems, which as of today still involve a lot of hired labor. |

| I hope you’ll enjoy reading our results, |

Yelto Zimmer

Coordinator of agri benchmark Cash Crop Network

|

|

Bullish ag commodity markets “forever” – not very realistic!

|

|

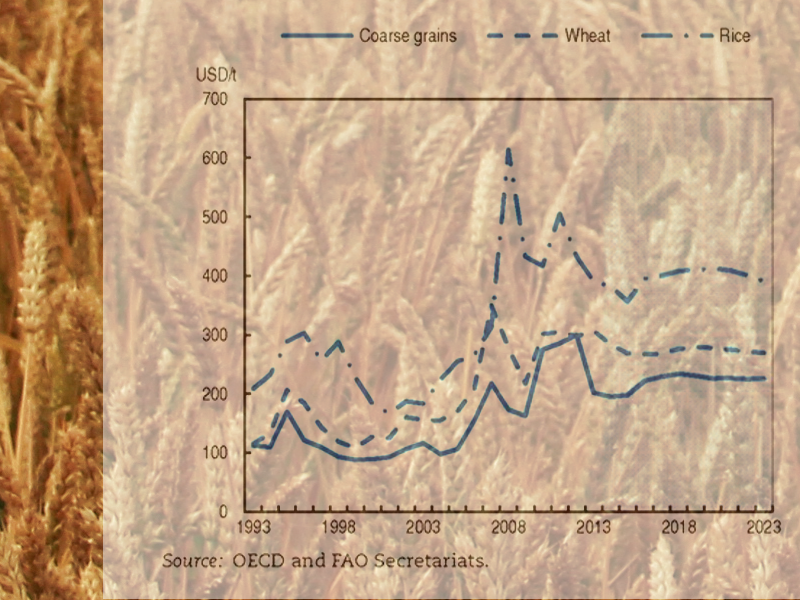

Both many scientists as well as the ag community tend to think that currently high commodity prices will remain high in the foreseeable future. For example, OECD is projecting a wheat price level of about USD 270 per tonne.

|

|

| A paper by Yelto Zimmer attempts to systematically develop and challenge hypothesis which would support the assumption of a fundamental change in ag commodity prices. The main conclusion: It is not very likely that prices will stay high in the long run. |

» A new Paradigm for Global Agricultural Commodity Markets?

Working Paper 2015/7, pdf-document, 3.577 KB

|

» Summary: Working Paper 2015/7

pdf-document, 360 KB

|

Challenges for rice farmers in Asia to pay competitive wages

|

|

Countries such as Vietnam and Thailand experience a strong and ongoing growth in industry as well as in service sectors. Therefore, general wage rates went up significantly. Traditional rice production systems have been rather labor intensive because of low wage rates. The new economic framework conditions in these countries make it very hard for growers to pay competitive wages.

|

|

| Consequently, the increase of labor productivity in rice is going to be a (if not the) future challenge. A new agri benchmark report analyzes farm level economics on main rice producing regions in Southeast Asia. |

» Summary: Economics of Southeast Asian Rice Production

(pdf-document, 68 KB)

|

» Economics of Southeast Asian Rice Production

Report 2014/1, link to agri benchmark website

|

Large-scale corn producing farms in Africa performed significantly better compared to the small-scale farms

|

|

Driving factors for this finding are: mechanization, the efficient fertilizer and seed utilization, use of plant protection products, and the application of lime in selective cases.

|

|

| The new Agricultural Outlook from the “Regional Network of Agricultural Policy Research Institute” (ReNAPRI) provides a baseline scenario and future projections of corn markets within selected regions in Africa. The farm-level work within ReNAPRI is based on agri benchmark data: The analysis includes impact assessments of domestic policy on regional trade flow patterns as well as farm profitability. |

» Summary: ReNAPRI - 1. Annual Agricultural Outlook

(pdf-document, 269 KB) |

» 1st Annual Agriculture Outlook: 2014 - 2023

(pdf-document, 6,17 MB) |

|

The agricultural sector in South Africa is characterized by substantial reductions in profit margins relative to the past 5 years

|

|

To be able to compete in the global context, continuous intensification will need to be supported by the adoption of improved technology. Additional costs and the uncertainty regarding land reforms make the situation even more difficult for farmers.

|

|

| The Bureau for Food and Agricultural Policy (BFAP) has analyzed these and further aspects and published an outlook of agricultural production, consumption, prices and trade in South Africa for the period 2014 to 2023 and relates these results to anticipated investment trends and trade flows on the African continent. |

» BFAP Baseline 2013 - 2023

(pdf-document, 9,4 MB)

|

|

agri benchmark – key note speech at the US Ag Summit

|

|

More than 800 crop and livestock producers, industry experts and decision makers from across North America listened to Yelto Zimmer´s key note speech at the DTN/The Progressive Farmer Ag Summit in Chicago in December 2014.

|

|

| One of his conclusions is that the US commodity production is very competitive, due to low production costs at farm level as well as low transport and logistics cost. |

| » Interview with Yelto Zimmer at the AG Summit 2014

|

» US grain production - How does it compare from a Global Perspective

Presentation at the AG Summit, 2014

|

agri benchmark in the media

|

How big is the global potential of potatoes?

In the past, potatoes were a regional product in contrast to cereals and oilseeds. But in recent years the worldwide trade with potatoes and their processed products increased. Therefore agri benchmark analyzed the production costs and some results were published in the German magazine ‘Bauernblatt’. |

» Wie wirtschaftlich ist die Kartoffel weltweit?

Article in German

Bauernblatt, 14/11/07 | |

Other crops than rice are becoming rather attractive in Southeast Asian Countries

The Homepage GREENMAC shows the main results of the new agri benchmark rice network report. |

» Südostasien: Alternativen zum Reis werden gesucht

Article in German | |